Top global risks in 2026 and how the Davos 'spirit of dialogue' can help us face them

播客文字稿

This transcript has been generated using speech recognition software and may contain errors. Please check its accuracy against the audio.

Gayle Markovitz, Head, Written and Audio Content, World Economic Forum: Welcome to Radio Davos, the podcast from the World Economic Forum that looks at the biggest challenges and how we might solve them. I'm Gayle Markovitz.

This week, with the Annual Meeting in Davos just days away, we're asking, what are the biggest risks facing the world in 2026 and beyond?

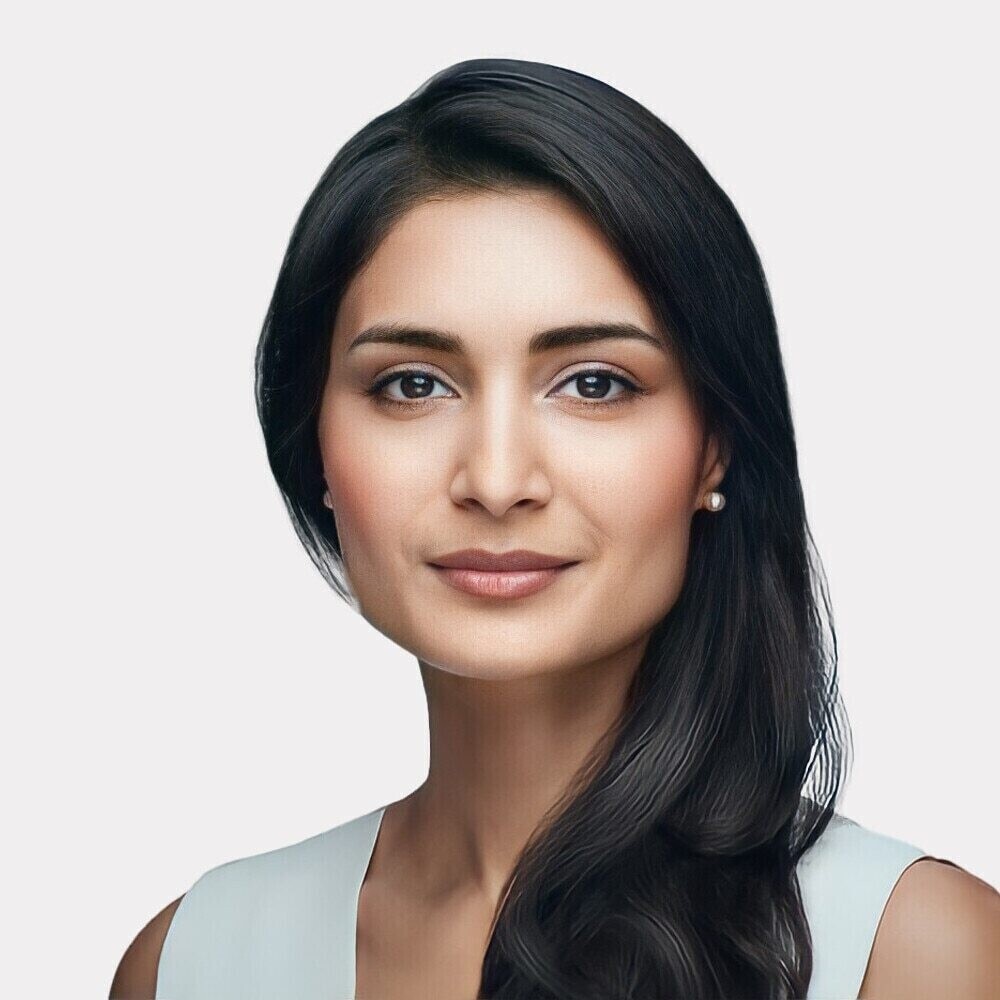

The World Economic forum has just published its annual Global Risks Report, which seeks to answer that very question. And to help me dig into that, I'm joined by my co-host, Saadia Zahidi, who is Managing Director at the World Economic Forum. Saadia how are you today?

Saadia Zahidi, Managing Director, World Economic Forum: I'm very good, great to be with you.

Gayle Markovitz: Can you give us a little bit of background on the Global Risks Initiative, and what that is, and how we compile the data for this report?

Saadia Zahidi: What we're really trying to do is to do is pull together leaders from across business, government, civil society, academia and international organizations and take that multi-stakeholder view to understand where do different global risks stand, what is their priority order relative to each other, but also how their severity scores might be increasing or decreasing in three different timeframes: this particular year, two years from now, and 10 years from now.

And we've surveyed over 1,300 business leaders, academics, and experts to try to understand what is happening with global risks. And then we've married that up with a series of consultations with some of those top experts, over 100, both inside the forum and outside the forum.

Gayle Markovitz: What is the main headline this year?

Saadia Zahidi: So we find that, of course, in the very short term, and this is probably no surprise to our audience, but in the short term geoeconomic confrontation and state-based armed conflict are the two things that leaders are extremely worried about in 2026.

And then you look two years out, and geoeconomics confrontation actually stays at the very top, but it's followed closely by mis and disinformation and then societal polarization.

And then in the longer term, in that 10-year outlook, that is where the environmental risks are, again, at the very top, extreme weather, biodiversity loss, and critical changes to Earth systems. But following pretty closely behind is, again misinformation and one of the largest rises, which is around the potential adverse outcomes of AI technologies.

Gayle Markovitz: I'd like to bring in two experts that we've got joining us today. Let's meet our guests. We have Andrew George, who is from Marsh Risk, and Peter Giger, who is from Zurich Insurance Group. Welcome.

Before we dig into the specific risks, I thought it would be good to just talk a little bit about the global outlook. Are we pessimistic? Are we optimistic? What is the feeling, what is the vibe for this coming year?

Saadia Zahidi: Well, because it is the Global Risks Outlook, I think it would be hard to describe it ever as being overly optimistic.

But what we do try to do is get people to say, what do they generally think will be the outlook for the world in the next two years and then in the 10 years?

And what we find is that in the two-year period, 50% of the experts that we surveyed are expecting the world to be somewhat turbulent or stormy.

About 40% are expecting things to be unstable, but perhaps manageable.

And then when it comes to the rest, that's about 10% of people that expect things to be either completely calm or somewhat stable.

So it is, of course, quite a pessimistic outlook. And then it gets more pessimistic when you look 10 years out, in the sense that 57% of these experts find that things will be stormy or turbulent, and the set of people that are expecting things to be somewhat manageable but unstable actually decreases, and the share of people that expect things to be calm or stable actually stays roughly the same. 1% expect things be calm, and about 9 or 10% in the two and 10 year time frame expect things somewhat stable.

So overall, we are looking at a lot of concerns, and I think it's not surprising, because so many different types of risks across the five risk categories we look at are actually happening and unfolding at the same time.

Gayle Markovitz: Can you just run through the five risk categories?

Saadia Zahidi: We look at societal risks, economic risks, technological risks, geopolitical risks, and environmental risks, and we look at about 33 different risks within those five categories and try to get people to assess where they are overall in terms of severity and relative to each other.

Gayle Markovitz: One of the things that came out of the report is that we are in an 'age of competition'. What does that mean exactly?

Saadia Zahidi: I think we can see that the multilateral order that has been keeping the world moving forward and creating progress and managing global cooperation, is something that is starting to fray, that's starting to come under pressure.

And there are major powers as well as middle powers that are starting to compete with each other when it comes to resources, technologies. And that's really what we're seeing playing out as underlying a lot of the risks that we're seeing this year.

And so we describe that as a potential age of cooperation. And I think I add the word potential to be very clear that none of these are predictions. These are essentially perceptions of where these risks might be headed.

Gayle Markovitz: So it's not a foregone conclusion, and if anything, by calling it out as a risk, we are some way to mitigating it.

Saadia Zahidi: That's very much the purpose of the Risks Initiative as a whole, to try to get people to look at some of these risks, call out where the problems might be so that we can actually begin preparedness today, begin to focus much more on resilience, and of course, begin to focused on cooperation where it is possible to mitigate these risks.

Gayle Markovitz: I'd like to bring in Peter, if I may. Do you agree that we've entered an age of competition and are the rules of the game completely different now? And what does that mean for businesses and for insurance?

Peter Giger, Group Chief Risk Officer, Zurich Insurance: I mean, age of competition. We've seen system competition before. I think humans are very good in forgetting the past. It's not so long ago that we had two systems competing globally, until capitalism basically got the better end of it. So I think we see a return of a systems competition.

And what does it mean for business? I mean it means that we're living in a world that is multipolar where kind of the political actors kind of pursue their own agendas, which can be good or bad for business because change is always opportunity. It offers new opportunities while other doors may be closing.

What does it mean for insurance? Look, we're not playing at that level. We're not insuring states. So most of these geopolitical risks are basically not in the insurance space.

A world that is perceived as less certain, obviously we would see it as a business opportunity because people buy insurance if they think uncertainty is real.

Gayle Markovitz: Andrew, from your perspective, how are businesses navigating this? I think geopolitical muscle is one of the things that businesses are now having to really tone, shall we say. Would you agree?

Andrew George, Global President of Specialties, Marsh: Yes, I think, you know, there's no doubt. There's examples of the challenge. US tariffs being the highest rates since, say, the 1930s.

Also, other issues that we shouldn't forget whilst perhaps dropped down the list of extreme weather are other things.

And so what companies are doing is really saying, we need more tools and we need to have more data to generate more insights to understand these situations. As the landscape unfolds, as things become more competitive, companies are using those data and insights, and a lot of it is using the emerging AI tools.

So we, for example, have our own supply chain AI tool and companies are saying, well if we can model the risk and understand the risk whilst it's evolving and it's changing, then we have an ability to manage it. Effectively, better data enables us to lead to better outcomes, and that's whether they're managing their own business or whether they use the insurance market who are very good at when you can model a risk, taking that risk and dealing with it.

So companies are really leaning in to how they manage this ever-evolving landscape.

Gayle Markovitz: If we dig into geoeconomic confrontation it's something that we kind of rattle off as a term because we're used to it and we've lived and breathed this report, but what exactly does that mean, geoeconomic confrontation?

Saadia Zahidi: I think there are multiple elements of this.

One element which is very front and centre these days is of course higher tariffs. And while tariffs have generally ended up being a little bit lower than they were originally expected to be when announced by the US government earlier last year, they are still higher than they were before. And so there is some concern around that and I think that's very clearly why this risk has shot up to the very top of the rankings both for this year and two years out.

But in addition to that, there's also concerns around what that means for investment screening, what that means foreign direct investment, what that means to some extent for development.

So there are many smaller economies that very much rely on global economic cooperation. And they're much more concerned about this kind of competition when it comes to trade and investment. And for them, this has been one of their key growth policies. And I think there's now starting to see how exactly is it that they think about their growth in a world that is competing a lot more and where geoeconomic warfare, if you will, has become a key part of the feature of the global economy.

Gayle Markovitz: How does it differ from what we had last year, which I think was one of the top risks, which was geopolitical recession? What have we seen? What's the journey been?

Saadia Zahidi: So I think we're actually seeing a continuation.

We didn't quite see geoeconomic recession or geopolitical recession as a specific risk. We were just describing what is starting to happen overall.

So we've, certainly for some time since the pandemic, there has been concern about an economic recession. And I think this was more a description of starting to see a geopolitical recession. And to some extent, we're seeing a continuous of those trends.

But I think and this is where you know the flip side of the the risks report, we shouldn't underestimate where there is still continued economic cooperation, where maybe the multilateral system is not working in the way that it initially was, but you are starting to see cooperation between larger powers as well on certain areas.

There continue to be, for example, regional trade agreements. So I think it's important to just bear in mind that there's also the other side of this, which is leading to greater cooperation among certain states.

Gayle Markovitz: I mean the markets have been pretty resilient, so I'm interested that this is a top concern, that economic worries are rising.

Saadia Zahidi: Yeah, so economic concerns have actually been among those that have been rising the most relative to previous rankings, so risks such as inflation have gone up, risks such as the concerns around an asset bubble have gone up, and again, this is in part because of the valuations, for example, in technology firms and some potential concerns around that, but there's also a concern about what happens in terms of the knock-on effects of tariffs.

We haven't necessarily seen that lead to higher inflation over this last year, but will that change over the coming year as some of those stocks start to deplete and you actually start to see the costs of those higher tariffs being passed on to consumers?

So those are some of the key concerns we're seeing on the economic front.

Gayle Markovitz: Peter, are you concerned about the macroeconomic outlook, and do you think economic and societal risks are somewhat underestimated?

Peter Giger: You know, it's always hard in the short term, but I think we have a couple of structural risks that are out there that are quite frightening.

I mean, we're looking at markets that are very highly valued, like almost across the board, no matter what you look at. And a market correction would have material economic implications because it's all our savings that are behind there.

And then I think, beyond that, we're looking at the scenario where we look at ever-increasing public debt with populations that are starting to shrink. I think that's a toxic combination that I'm not sure we're paying enough attention to.

Gayle Markovitz: It's a good segueway to one of the next parts of the report, which looks at polarization, societal risks, values at war. Can you tell us a little bit about that and how that's been in the past and what that's looking like now?

Saadia Zahidi: So we look every year at the interconnections between these risks and we try to find out where are the strongest connections.

And for the second year in a row, inequality is the most interconnected risk. So it's essentially the risk that leads to greater effect on all of the other risks and in turn is affected by all of other risks as well. So that's where we see the strongest interconnections.

And I think that's again not surprising because you've got, for example, mis- and information as one of the key additional risks and as technology advances as the risks from deep fakes, for example, rise. And we looked at this a couple of years ago, what that means, for examples, for elections, you're starting to see there that that mis and disinformation is growing and fueling the fire of societal polarization.

In addition to that, in the current situation, you've got this risk of, we were talking about K-shaped recoveries a few years ago, right now, there is this risk of more permanently entrenched K-shaped economies, where some sectors do very well and other sectors that are really not getting that same kind of growth, which then, of course, leads to greater income inequality.

And we see that across the report. We see this concern around inequality, lack of economic opportunity, potential risks through the job market, through artificial intelligence, and all of that combined with this broader societal polarization that has been quite steady and high in the rankings for some years.

So I think all of this together is fueling this piece around inequality and values at war.

Gayle Markovitz: So when we say that inequality is the most interrelated risk, does that mean if we fix it, we could fix some of the other risks?

Saadia Zahidi: I think there are not necessarily any silver bullets when it comes to this. I think inequality is a long-standing issue. It, definitely, some of the latest research over the last few years has shown that actually inequality can, for example, hamper economic growth.

So you don't necessarily have simple solutions like grow your way out of inequality and at the same time only redistribution would also not lead to broader growth that allows for progress for all.

So I think it's more complex than that. But it is very clear that if we don't start breaking some of these connections and start looking at those that have been losing out from the economic systems of the last few years, then this particular pattern will continue.

Gayle Markovitz: It's a good moment to talk about technology. I think no conversation would be complete without a mention of AI and technological transformation.

There's quite a lot in this report about the disruptions that we're seeing. AI seems to have seeped into the consciousness. We can't get away from it. It's very disruptive. So, question to Andrew, how are you seeing AI affect... Business operations and what are the actions that business leaders could take to manage this transformation.

Andrew George: So there's no doubt we are seeing the advancement in AI and quantum computing is reshaping labour markets. And it has got some real implications.

Many people look at the downsides but also there are many upsides.

What I would also say is each sector, and when we talk with clients we break ourselves into sector by sector, whether that's the construction sector, the energy sector, and the logistics sector, and the impacts are felt differently in each sector and we're already seeing advances there.

One of the things though that is a challenge, is the misuse of AI. You know, I think there is some concern around yes, AI can help advances, help the offerings in the particular sector as I say, we talk about the creation of data centres and digital infrastructure, some huge opportunity there, but equally there are some huge risks that companies face along the way with that.

And we've already seen how the use of technology and AI can lead to an erosion of trust through mis or disinformation.

And what I'd also say is, with these advances, it can also make businesses more susceptible to cyber attacks, attacks against critical infrastructure.

For example, let's look at a cyber attack on a cargo ship's navigation system that may challenge the cargo ship and their ability to deliver what they need to deliver. But what it might mean, if you've got a ship with perishable goods, is not only can't deliver, that entire cargo or significant elements of that are destroyed or have less value.

You know, there are also challenges that can manifest if you are building a digital infrastructure, data centre, someone attacks the heating system or the cooling system relative to that, suddenly you have an impact.

So I would mark it that there's fantastic opportunity and there are many of those that will take advantage of that, but by the same token it does create more risk as these risks emerge. And the successful companies will be those that understand those, plan for those, and build resiliency into their planning for the unintended consequences that can happen.

Gayle Markovitz: So digital infrastructure is super important, which just reminds me of Peter, your piece that you've written for our platform, your article, which is about critical infrastructure. What are you seeing there? Are we worried enough about our critical infrastructure?

Peter Giger: I don't think we are, and I think the risk report shows that the perception is basically that the infrastructure is there and it works and we don't need to worry when we should. And I think for various reasons we should worry more.

We see a lot of countries where the maintenance is underfunded, so even the infrastructure that we have is not properly maintained and degrades and becomes kind of more susceptible to interruptions.

But it's also like the exposure to external factors, be it environmental. I mean, we see droughts that principally challenge water, energy. We see that challenge the cooling of nuclear power plants. I mean we've seen that now in a couple of summers.

At the same time, you see attacks on infrastructure. A lot of the critical infrastructure like underwater cables or electricity grids are principally unprotected. And so there is a frightening number of angles where our infrastructure that we critically depend on is exposed from a lack of maintenance, but also it's open to attacks, it's open to environmental threats that are increasing with global warming. And yes, the short answer is we don't worry enough.

Gayle Markovitz: Moving on to the next risk category, which is environmental, what did we see there, Saadia?

Saadia Zahidi: Yeah, so this is quite concerning, because we see that over the next two years, environmental risks have essentially been deprioritized. And even 10 years out, their severity scores have gone down, even though the top three risks over the 10 years remain environmental.

And I think the concern is obvious. This is obviously an existential risk. But even if we bring this down to its relatively more near-term economic impact, if you just think, connecting back to what Peter was saying - droughts, floods, wildfires, loss of nature and biodiversity, all of that has a huge economic impact even in the shorter term. So I think the fact that these have been de-prioritized is concerning, but it's also to some extent understandable because there has been this focus on shorter term risks around geopolitics, around geoeconomics, around potential asset bubbles. All of that is starting to detract the attention of many leaders and experts. But that is not to say that this isn't something that we also need to be looking into.

And of course, here there is a wider infrastructure of international cooperation that really does need to continue.

Gayle Markovitz: I mean, Andrew, do you think there is more that can be done, that leaders could focus on particular actions, that steps could be taken to get this higher up on the agenda?

Andrew George: I think if people can measure risk, one of the challenges with perhaps misinformation, disinformation and bias is it has enabled it to perhaps move down the list.

One of the things that we see is the more robust data and the more of a return that you can demonstrate, an economic return, if I manage this the outcome statistically can become that, then that is going to make it much easier for people to have that as a continued focus.

It comes back to the whole tenet throughout these risks is if they're measurable with robust data it's much easier to manage them and either through the business manage them or one of the things I've referred to is insurance companies are very good if you can demonstrate that measurability in deploying their capital to help companies manage and mitigate those risks.

So there's definitely more to become but as the risk landscape continues to evolve that measurement is going to be absolutely critical.

Gayle Markovitz: So measure it is the short answer. Yeah, thank you. So looking ahead, I feel we need to find some reason for optimism, surely. So it's a question to all of you, starting with Saadia. Is there anything that gives you cause for optimism this year?

Saadia Zahidi: Yes, I think it's perhaps very obvious to talk about, but we're bringing together nearly 3,000 global leaders next week at our Annual Meeting in Davos. And they're all coming together under this broader theme of a spirit of dialogue.

And I think that's the very basic that we need to try to aim at. We need to bring people together and have constructive conversations, even with diverging viewpoints, how we can advance some of the progress that needs to be made against these risks.

And that applies to the economic domain, to the environmental domain, the societal domain, and that's very much where we'll be focusing over this coming week.

Beyond that, I think, as you can see in the report, we do, for each one of the deep dives around these risks, we do point towards some of actions that need to be taken today.

And while some of this is about ensuring that we support the multilateral and international cooperation structures that currently exist, it's also about more than that. It's about building coalitions of the willing between those states that are willing to work together. It's a about localizing solutions at a national or a community level. And it's about having some of those more minilateral or regional agreements that need to take place between countries.

So I think the solution set will have to expand. But the good news is there are solutions. And most of these risks can very much be dealt with and prepared for.

Gayle Markovitz: Peter, do you agree?

Peter Giger: I'm an eternal optimist, you know, humans have an incredible ability to adapt to whatever circumstances they are confronted with and we're going to kind of collectively make the best out of this situation as well.

We're also incredibly afraid of change. So whenever we're confronted with an environment that is changing, we don't like it. And so I think that's the combination we're looking at.

Kind of we make incredible progress on a technological front on many fronts the world was never a better place to live on than today but, here's the but, we we see all this change we see all the risks and and we tend to be afraid rather than optimistic and trust in our ability to adapt because that's what it will take things will not stay the way they are but that doesn't that doesn't mean they need to kind of go for the worse they can also develop for the better

Gayle Markovitz: And Andrew, I know you're a glass half full when it comes to technology and you see lots of opportunities, so any words of optimism for us?

Andrew George: Yeah, I mean, you know, we've Marsh have been operating for over 150 years and throughout that period, there have been periods like this where we feel this isn't new, this is different. And, you know we come through them, you find a way through.

You know, human beings are curious, you know and as you know we're looking for solutions, we're looking for a way forward. It's the business we're in and you know our role and the role for society to prosper is how we find a way through this and the challenges today won't be the same as the ones tomorrow and there'll be different ones the day after that.

But what's super exciting for me is how, we meet those head-on and we solve for them.

Isn't easy. It needs partnership, it needs public, it needs private and it needs collaboration, a coalition of the willing. And if we can build back some of that trust that sometimes gets eroded, then together I'm very optimistic that we can do some really exciting things that can fuel the next phase of growth.

Gayle Markovitz: That's a great sort of segueway to our annual meeting next week. Lots of work to be done.

There's a lot more on our Global Risks Report, and you can find the whole thing, as well as more analysis on our website. That's wef.ch/risks26. And across social media using the hashtag #risks26.

Many of these big issues, as we've said, will be under discussion next week. Our Annual Meeting in Davos opens on January the 19th. You can follow that on our website. That's wef.ch/wef26, and across social media, using the hashtag #wef26. Follow Radio Davos wherever you get your podcasts. Which will mean you don't miss our daily audio shows from the heart of Davos next week.

And thank you to Saadia, my co-host, and to our guests, Andrew and Peter. Thanks very much.

The Global Risks Report, the World Economic Forum's annual snapshot of the biggest risks facing the world in the near, medium and long terms, shows geopolitical and economic risks on the rise in the new 'age of competition'.

The report is published just days before the Forum's Annual Meeting and is a good indicator of what the 3,000 leaders convening in Davos, Switzerland will be talking about.

Gayle Markovitz is joined by a co-host, Forum Managing Director Saadia Zahidi and two expert guests, Peter Giger, Group Chief Risk Officer at Zurich Insurance, and Andrew George, President, Specialty at Marsh Risk.

The Global Risks Report, available here, was compiled by Mark Elsner and Grace Atkinson of the Forum's Global Risks Initiative.

Related podcasts:

主持::

话题:

风险及韧性分享:

更多集:

每周 议程

每周为您呈现推动全球议程的紧要问题(英文)