Are we on track for the energy transition? Insights from three CEOs

播客文字稿

This transcript has been generated using speech recognition software and may contain errors. Please check its accuracy against the audio.

Christian Bruch, CEO, Siemens Energy: There has been never a time, I believe, in this industry where the speed of change has been so fast.

Robin Pomeroy, host, Radio Davos: Welcome to Radio Davos, the podcast from the World Economic Forum that looks at the biggest challenges and how we might solve them. This week, how is the energy transition doing? We hear from three CEOs from companies on the front lines of the rapidly changing global energy sector.

Christian Bruch: Resilience is today the dominant discussion point, and resilience covers a lot of things, the sustainability element, the availability of supply, and it covers also, obviously, on how do you actually build an infrastructure in a geopolitical world which is probably more challenged than it is.

Robin Pomeroy: Renewables have become far cheaper than anyone expected. Can they help cope with the growing demand for electricity, not least from the rush to build energy-hungry AI data centres?

Andrés Gluski, CEO AES Corporation: At this time, renewables are absolutely crucial, absolutely essential to get these data centres built, to get them built quickly, and to continue to have the social buy-in to placing large data centres sucking up a lot of energy in different communities.

Robin Pomeroy: And can improved storage technology, ensure that renewables deliver even when the sun isn't shining and the wind isn't blowing.

Lei Zhang, CEO, Envision Group: I'm quite confident to see the long duration battery storage is going to play a vital role to replace gas.

Robin Pomeroy: I'm Robin Pomeroy at the World Economic Forum and with this look at the energy transition from three energy CEOs.

Andrés Gluski: You can't lean against technology. It's going to be hard to stop that.

Robin Pomeroy: This is Radio Davos.

Welcome to Radio Davos and this week, we're talking about the energy transition and I'm joined by a co-host this week. His name is Charles Bourgault. Charles, how are you?

Charles Bourgault: I'm good, thank you Robin.

Robin Pomeroy: What do you do at the World Economic Forum?

Charles Bourgault: So here at the world economic forum, I am managing the electricity industry community.

Robin Pomeroy: So that's a community of who or what exactly?

Charles Bourgault: It's around 50 partner companies in the electricity value chain. So that will be utilities, grid operators, technology manufacturers, companies that are on the energy demand management side, all those really who are producing and helping people consume our electricity. And you

Robin Pomeroy: When you say they're a community, that means they actually meet each other and you convene them and bring them together.

Charles Bourgault: Yes, exactly. So they convene regularly two, three times per year to discuss indeed the challenges facing the industry and how they can contribute to the forum's objectives of improving the state of the world and advancing their, in this case, advancing the energy transition for society and the economy. Now you came to me and said you've

Robin Pomeroy: got this community of amazing companies, brilliant people there. Perhaps if we reach out to one or two of them we can talk to them about they're people really on the front line of trying to make the energy transition happen and that's what we've done. So over the last couple of weeks we've been interviewing, we've actually got three interviews we're going to play out today. What did you say to them when you said will you join us? What were you telling them we would be asking them?

Charles Bourgault: So I think the energy transition at the moment is facing many challenges, and it's taking also different pathways, depending on the countries where you are. So it was interesting to indeed sit down with CEOs of companies that are active in many different parts of the world to see how the transition is playing out in those different parts, what are the challenges that they're facing, what they think will be the way ahead in those geographies. So I thing they each shared their views, and that's really interesting to listen to.

Robin Pomeroy: It was really fascinating for me. I mean, on Radio Davos, we do a lot about climate change, we do lot about energy, but it's always interesting to speak to people who are really getting their hands dirty, you know, building the infrastructure that's required to make these things happen. And these were three, as you say, very different companies from very different geographical locations doing different things.

Who's the first one?

Charles Bourgault: Christian Bruch, who's the CEO of Siemens Energy. Siemens energy is manufacturing equipment for the grid, also for wind turbines and gas turbines, so they have kind of a good overview of what's happening with a global presence.

Christian Bruch, CEO, Siemens Energy

Christian Bruch: Let me start with our purpose. We energise society. And this is fundamentally what more than 100,000 people do across the globe and in around 100 countries all over the world.

We have built roughly a sixth, a fifth of the global electricity production worldwide. And obviously, we do it on the one side by really building generation capacities. This could be renewables, this could be gas. But at the same time, also bringing electrons to people via transmission technology.

And we obviously also try to get our arms around energy and electricity supply towards industry.

So what could we do, hydrogen, what is the next electrification of industrial processes?

So that is a very broad picture which we are driving. But we are also very much about really executing, realising project, building something, right? Building the next transformer station, building the next gas power plant, building the offshore wind park.

And as I said, this we do around the globe since 178 years. Even so, we have been spun off roughly five years ago from Siemens and are acting as a separate company in the German DAX. We obviously have a long history and long legacy from Werner von Siemens. And this is obviously what drives us every day to energise society.

Robin Pomeroy: Going on for well over 100 years, but we're in an energy transition now. How's that going?

Christian Bruch: People easily talk about energy transition, right? But what you see at the moment happening, there has been never a time, I believe, in this industry, where the speed of change has been so fast.

And I have to stay in that regard, lots of things are happening. People building out grid infrastructures. More generation capacity is built. There's an unprecedented level of investment into renewables.

So lots of thing are happening, we are growing as a company on a CAGR [compound annual growth rate] double digit percentage, I've never seen that before, right? And we are investing around two billion this year in expanding our capacity.

So lots of things are happening to build that energy infrastructure and to accompany this energy transition.

However, we also have to clearly say, if you look back to Paris, to the different scenarios, what we have seen in the sense of really driving sustainability and getting the CO2 footprint down, we are too slow. At the same time, we see obviously an unprecedented need for electricity. We see continuous electricity growth. And this is not matching yet in terms of all what we're doing.

So despite this incredible speed, we are failing to meet the original targets in terms of temperature increase, what we all were aspiring. And that is the challenging situation at the moment.

So I would say lots of things ongoing, a lot of positive elements, but at the same time, not fast enough.

Robin Pomeroy: So despite a rapid increase in electrifying industries and various ways we do things, that's being offset by just a huge rise in demand, which can't be met by renewable energies, for example.

Christian Bruch: Yes, and what we may have underestimated to a certain extent, how big the replacement need is also, right? I mean, you at the same time, you're trying to serve growing demand, but at the time, a lot of the infrastructure in the electricity world is 40, 50 years old and needs replacement.

This putting us at a challenge that you can not just do everything by renewables and batteries.

And what we also have learned is that you have to think system-wide. You have to think generation and transmission and distribution and storage, right?

And it's somewhat at the end, what is the best solution? What provides you also stability of an electricity supply is a mixture. It's a mixture of things. There's not one silver bullet. It's a relatively interconnected complex system which needs to be managed.

Charles Bourgault: About the direction of this transition, because there's a lot of talk about energy dominance lately, also some talk about energy resilience. Where do you see that headed and how is that playing out with each other?

Christian Bruch: Well, obviously, five years ago, everybody was talking about sustainability. We know that electricity and energy supply is at the end, the base for every societal development, for every stable society. These people need energy and electricity. And in that regard, we obviously also have seen how vulnerable you are if you don't have that.

And resilience is today the dominant discussion point. And resilience covers a lot of things for me. Resilience covers also the sustainability element. It covers also, the availability of supply. And it covers also obviously on how do you actually build an infrastructure in a geopolitical world, which is probably more challenged than it used to be.

And all of a sudden, you're down to the material supply, to the supply chains. What else could happen?

And one thing which is obviously particularly dominant at the moment is does a country or does a region have enough electricity to power data centres to develop AI models? Because at the end, the question is who will reach supremacy on artificial intelligence model? And you will only have this if you have electricity in abundance.

So you do see that obviously this resilience element is each and everywhere if it comes to energy and electricity, you cannot untangle that. And this is also why obviously today we much more focus on also our company to ensure that enough power supply is available, no matter how.

Robin Pomeroy: And what's the key to resilience?

Christian Bruch: I think the key to resilience is at the end also to be diversified.

I mean, if you talk about certain elements, there's never the silver bullet. And because it is infrastructure, you are vulnerable. You can attack it in whatever way. And because you have global supply chains, it's vulnerable because you're dependent on certain suppliers or certain regions.

So I think, the only trick is, first of all, to think about resilience when you design a system, when you're design an infrastructure. Think about what could happen. And I think that is the first step really to get to better resilience.

And then the second point is really in all these dependencies, make sure that you diversify your risks. That from where you source your LNG, from where you bring your copper, from where you source components. And that is something where there will never be the one solution which makes you 100% resilient. But it's a mixture of measures.

The one thing we have to understand, and this is maybe underestimated. Resilience will cost money. It's like an insurance. Are we willing to spend the money in a world where we are also competing on energy costs in terms of the competitiveness of the region?

That is a difficult balance to strike, right? On the one hand, you have to spend the money to be more resilient. On the other side, you're competing on energy costs with other industries, and you cannot afford each and everything.

And this is why it will always be a mixture. There's not a 100% perfect solution. But I think it starts all with, think about it. Think that you could be vulnerable. The one thing is on the design.

The other thing is also, I think we all have learned with the Ukraine war. With other incidents, how do you rebuild systems, actually? How can you design a system if certain things break down for whatever reason? Cyber attack, a war, or anything else, or coincidence. How can bring a system back to produce electricity if it's down? So that is the second element which comes to resilience.

But it's complex, and it will cost money.

Charles Bourgault: Given the current geopolitical and economic environment, would you say that is becoming harder, unachievable? Or what's the situation there in terms of resilience, in terms also of sustainability, and in terms providing enough electricity to the economy?

Christian Bruch: I would say absolutely the problem got more complex because you have more things to encounter. And in a world where you have to think through the resilience of your supply chains and certain disruption on a regional side, absolutely it's more complex.

And we as a company spend today more time to manage, strategize around the resilience of our supply chain than we did maybe five years ago. And obviously the assumptions in terms of what could be this black swan event, where really something fundamentally changes the picture, have gotten more in our discussions.

If we discuss strategy today and what to do over the next five years, these outlier events become more prominent. They will not define your day-to-day strategy.

Robin Pomeroy: What do you mean by an outlier event? What kind of thing?

Christian Bruch: Well, it could be a war, right? It could be war which completely cuts you off of a region, right. And you cannot plan for this in your day-to-day exercise.

You cannot always assume the worst. But what you have to ensure in these situations, you're still able to perform certain things and you're able to run your company. And that is, I would say, more intense than it used to be before.

Robin Pomeroy: You mentioned earlier the massive demand from AI and the kind of race for AI dominance, I think the way you put it. Do you think that also feeds into the international relations side of things?

Christian Bruch: I mean, AI will be a decisive tool for today and for the future, right. And who has an edge on AI will obviously also geopolitically have a lead. I'm strongly convinced on this. And absolutely it does influence that. And you see this.

I mean if I look on our gas turbine business, this year, roughly 50% of our annual capacity is devoted to the US. It's going there because they're pushing for electricity supply to ensure supremacy also on AI data centres.

And you see it effectively happening. You see these regions sticking out. Absolutely yes.

Charles Bourgault: And how do you see the whole of AI in the energy transition?

Christian Bruch: I think it's multiple elements if you think about it.

First of all, there is obviously currently simply this growth driver of electricity coming from AI. That's the one thing.

On the other side, it's an enabler. It's a fantastic tool to make grids more efficient, to really drive or use the physical assets what we have better. It's fantastic tool to do things faster. What can you replace in an engineering process by AI and just execute projects faster?

So there are so many elements in terms of really driving a different way of doing things with AI. It will be in the centre of everything what we're doing. And I think we are just scratching at the surface to learn it. I mean, we all obviously use the tools, try to get an understanding, but the potential for driving particular efficiency of processes or usage of assets. Just at the beginning.

So in that regard, there's no question that AI will help us in the energy transition. The question is how fast do we get into models that we really can scale?

We and our company have a lot of use cases where we test, where we develop, and either for ourselves in terms of how we do things, or for customers, products, optimisation, digital products in terms of rolling this out.

However, can you immediately roll it out through the whole fleet? Can you really scale it in the speed you like? No, I'm not seeing that, but it will be the tool to use to drive further energy transition.

Robin Pomeroy: Most of us don't have your job, at the head of a big company driving part of the energy transition. Just wondering on a kind of a human level, have you had experiences when you've been involved in a project, you've built something and you've really thought, wow, that's changed the way this is working. I'm sure anyone in a job, you do your day-to-day job, but do you ever stand back and think, what we've done there, we've really changed things.

Christian Bruch: I have the pleasure to work for a company which really physically does something and we do cool stuff, right?

I mean, if you see our equipment, how large it is, how difficult it is sometimes to build it somewhere, really in regions which are not easy and let it be of whatever, bringing energy back to Iraq or let's say rebuilding countries after a war or building a super big offshore wind park where you stand on 170 metres height on the nacelle and see a 110 metre long blade going in front of you. Or if I see what we're doing in research and development where you're really at the edge of technology, I have to say, I love to work for this company because you see so many things where you say, yes, you can really influence something. So lots of things.

If you'd ask me from a company or some management perspective, the one thing which I'm quite impressed over the last five years, listing a company and making it independent in the middle of Corona. While starting up power plants on remote, where nobody could travel. So the amount of changes and the amount innovative ideas what this company and our 100,000 people brought to the table and still have made this company independent, I found amazing. And that is obviously the energy of 100,00 people in one company. That's cool to see that.

Charles Bourgault: Maybe going back to infrastructure, because you mentioned several times infrastructure and I know you once said like the energy transition is an infrastructure project. But how do we build infrastructure in such an uncertain world?

Christian Bruch: First of all, I think in all uncertainty what we know is that we need more infrastructure and we do know that electricity consumption is going to grow.

Then that is the privilege of working in energy at the moment. The basis for the demand is existing no matter what. And yes, there can be elements which are influenced in this uncertain world, how fast, whatever, a battery electric is coming in the automotive or how fast a data centre. But we do know that population is growing. We do know that electricity share and energy is increasing. And no matter what if you want to build stable societies then it's needed to serve this demand.

And in that regard, honestly, I have to say I'm on the easier side of the table because the need for electricity for me is relatively certain in an uncertain world.

The challenge is at the end, how do you execute? How do you implement projects? And what is the versatility you do need in your system to amend the way on how you execute? Finding a different supplier, getting a different team, being more local.

But that is something what you can manage. And we obviously, we are a big company. And as I said, we're operating in around a hundred countries of the world which gives you some flexibility.

What we are trying to do as a company is to change our management structure a bit, to bring more agility into this responsiveness, because what you do see is the complexity got so high there is certain decision-making processes which by definition need to be more decentral to react on certain things. You cannot run it top-down anymore in the structures we liked to run it. So this agility element in a company is essential because planability is less pronounced than it used to be.

Robin Pomeroy: Are you optimistic about meeting the climate challenge?

Christian Bruch: Optimistic is probably the wrong word. I would say I'm a pragmatist, right? And from that regards, I would look on a massive challenge where we are not on track at the moment. But I'm pragmatic enough to say we work on the things that we can work on and it still contributes something. And this is what makes me proud. And every day I get up and know what I have to do and with the organisation in terms of working on it.

Whether I'm optimistic, whether it will solve the problem, I don't know. But pragmatism helps.

Robin Pomeroy: Christian Bruch, he's the CEO of Siemens Energy. Charles, it's very interesting what he was saying about, you know, it is a booming industry, electricity in general, renewable electricity even more, but there's also a boom in demand for electricity right now. That means just masses more renewable energy in itself is not going to get us to net zero.

Charles Bourgault: Yes, indeed, you're right. We need to decarbonize, but we need to do so in an environment where the energy demand is growing. Within this energy demand, electricity demand is growing even faster. And we have an old infrastructure. So we need to build, rebuild, modernise everything that we have in a short time frame. And he made that point.

Robin Pomeroy: About the replacement costs of old, you know, decades old infrastructure that just needs replacing, none of this is going to come cheap.

Let's move on to the second one. Who's our second CEO?

Charles Bourgault: So our second guest is Andrés Gluksi, the CEO of AES Corporation. It's a utility active in the Americas mainly, so the US as well as Central and Latin America. There again with a good view on the challenges across different countries.

Andrés Gluski, CEO AES Corporation

Andrés Gluksi: The AES Corporation is a multinational, it's a Fortune 500 company, headquartered in Arlington, Virginia, really Washington, D.C. We are the world's largest provider of clean energy to corporations in the world, and also the largest provider to data centres. So we run utilities, we run a large renewables programme, but we also have LNG and we have a new technologies group that's done a number of very exciting things.

Charles Bourgault: What are your views on the energy transition today and what kind of direction is it headed to?

Andrés Gluksi: I think there's a lot of noise in the system today about the energy transition. So it's sort of good to step back and look at the facts.

So in 2024, the world installed almost 600 gigawatts of renewables. Almost half of this roughly was in China. The bulk of it was in Asia. A little bit, about 12%, was in the Americas and of that the bulk was in United States.

So basically the world is building more renewables than anything else. And the speed is picking up very quickly.

Other realities, the price of solar has come down 90% over the last decade. The price of lithium ion batteries for energy storage has come 90%. So the reality is there's a lot more happening, I would say, in terms of the transition, than you might get, especially from the press in the United States.

But we are seeing a segmentation of markets. There's no question that say both solar panels and batteries are much cheaper outside of the United States because of tariffs. And I would say to some extent Europe as well, though less so.

So you really have a bifurcation. I would see outside the United states and some parts of Europe, it's very hard to compete with solar plus batteries in most of the world. It really is a killer app.

Now there is no question that there's overproduction in China and this has been helping to drive prices down. But it is an exciting time in terms of, if you look at any forecast anybody made over the past 10 years, in terms the growth of renewables, it has exceeded it.

So this should make us feel very, I'd say optimistic.

On the other hand, if you at the goals, say of the Paris climate agreement, or if you're look at the goal of net zero, we're behind it. So that has to do with quite frankly burning more fossil fuels. I think there were some assumptions were unrealistic in terms of the transition, cost of the transmission, but overall I'm very optimistic about what we can do with technology, where relative prices are.

Look, before I was in the electricity sector, I was in telecoms. And if there was one lesson I learned is that you can't lean against technology. So, first I worked in a large company, but I was part of the team that started mobile cellular. We went digital. And then we did an internet service provider. And even though, say, governments may want it to stay analogue or didn't want to invest in digital, or they wanted to keep prices high for long distance, they couldn't lean against the technology.

So my belief is that in the energy sector, you will see something similar. There's a lot of very promising developments as well. So I think that the transition will continue. I think we have to set a realistic pace. And I do think, you know, policy matters. So. It might slow down in the United States over the next couple of years.

Robin Pomeroy: Is there one reason that Asia has leapt so far ahead?

Andrés Gluksi: Really, the driving force here is China.

And there's no question that China is selling, especially solar panels, at a very, very low price and batteries as well.

Again, the bulk of this build out in Asia has been China. And I think this gets into things like geopolitics.

What's great about renewables is once they are built, you're totally independent of, say, imports or commodity prices. So definitely, I think China's had a desire to become more energy independent.

Additionally, there's a lot of talk about climate change, but nobody talks about particulate matter. And so the fact is that the air quality in China was dismal, was absolutely terrible. And it was affecting the health of their population. So by going to renewables, they've considerably cleaned up the air in their major cities.

We're seeing the same, for example, in India. India, the air-quality today is horrible. By building more renewables they can reduce the particulate matter and improve the quality of people's lives. So I think that's a driver as well.

So you have not just climate considerations, but you have local pollution considerations as well.

So on both these sides, I think renewables and zero carbon energy is really key to improving people's life.

Then you have the electrification. And if you look at what's happening with electric vehicle sales, electric vehicle sales in China have skyrocketed. And this goes hand in hand, again, with cleaning up the environment.

We're actually seeing a lot of new technologies, confluence of new technologies, which are pointing to a cleaner future.

Charles Bourgault: And what about new drivers of the transition? I'm thinking, you know, of energy dominance. There's also some talk of energy resilience. How does that play out?

Andrés Gluksi: Well, I think I've talked about energy resilience. And I think the renewables play a key role in energy resilience by making you, once they're built, independent of external factors.

So I mean, you know, once a solar farm is built in the U.S., whether those solar panels came from China or not are absolutely irrelevant. Solar panels are going to be there and work for the rest. So I think this has been a consideration in some countries' move towards a renewable. So I it definitely strengthens resilience.

Now, talking about energy dominance. Look, the United States is a very gifted country. If you look at it, it's the biggest oil and gas producer in the world today. And it was thanks to technological innovation and really a spirit of entrepreneurship of the small frackers who didn't know any better and kept, you know, going after fracking and driving down the cost. So the United State today is really the swing oil and gas producer.

And it's a tremendous advantage. And it really gave it true energy independence. United States has gone from a major importer to a major exporter. In fact, today it's the largest exporter of LNG in the world. So United States I would say in the oil and gas space does have a dominant role.

Now, a lot of the talk of energy dominance has to do with AI. Because if you think of AI, they're really sort of three pillars. I'd say first is programming. Second is compute. And the third is energy. This is a three-legged stool. If you're missing any part of those legs, you're not going to have energy dominance.

So obviously there's an international competition for this. So it's very important to have the energy to be able to power these large data centres.

Right now in the United States, what can be built immediately is in what's I would say in the queue, is a lot of renewables. You know, there is some consideration about using our gas plants more. And that certainly can be accommodated, but renewables will have to play a role.

So, you know, we're very fortunate to be, and I think the two most, I'd say, challenging and important sectors of our time or issues of our times.

So first I would say it's climate change. Climate change is real. It's accelerating. Those of us who have large hydros and run distribution companies, we're seeing its effects. We're seeing more extreme events. Over the last couple of years, the one in 100 events that I've had happened almost monthly for sure. So it doesn't make sense from a statistical point of view to say that the situation is not changing and it's changing for the worse. So certainly climate change has to be addressed.

I'd say the second is AI. And the two come together because AI is going to change the way we work. And it may have profound societal implications as well.

So AI is going to demand a lot of energy. Again, you have climate change, you have greater demand for energy because of AI. They need not be incompatible. And I would say AI is part of the problem, the energy demand that it has, but it's also part of the solutions.

It's going to very much help us, I think, with new materials, which are less scarce, which are more efficient, both from let's say generation of energy to the storage of energy to the transmission of energy.

Here at AES, we've been working for quite some time with AI. And together with one of the large technology companies, we came up with the first sort of digital twin for ISO, a network that allows you to really develop it more efficiently, despatch it more officially, react to let's say emergency events more quickly.

Because there's a lot of talk about generating more electricity. But the truth is people don't consume, you know, gigawatt hours or megawatt-hours. They consume the services that it provides.

And so we have to find a way to do more with what we have because the demand is immediate, but also, very frankly, from an ecological and climate point of view, if we can use the same amount of energy to produce more welfare for people, that's also going to reduce the cost of it and help people's lives more.

I think at this time, renewables are absolutely crucial because they are what can be built, let's say, in two, three-year period. So without renewables, you're not going to get this additional power.

So if you look at the United States, over the last three years, 90% of additions to the grid have been renewables. So it's absolutely crucial.

I think that we have to think about renewables plus energy storage. Because just renewables, yes, it would be too intermittent. But if you combine renewables plus energy-storage, they can power the grid.

Now it's, you know, I think also important to have an interconnection to the grid, it's also, you now, there's still a role for gas in this model, but renewables can supply the bulk of the additional energy.

And this is key, because if we don't have new energy, the price of energy in the States will go up. And I would say the social backing for more data centres in their area may falter. So getting those renewables online is absolutely essential to get these data centres built, to get them built quickly, and to continue to have the social buy-in to placing large data centres sucking up a lot of energy in different communities.

So, again, we have climate change, which we have to solve, and we have AI. AI makes challenges because we have more energy, it's going to disrupt, let's say the industrial process, but at the same time can offer many solutions. Not only in new materials, but in how we consume the electricity.

Charles Bourgault: I was wondering also if like, we were talking about challenges. So what about, you know, the geopolitical, geoeconomic situation, the tensions, and you mentioned also the bifurcation, what are your views there?

Andrés Gluksi: Well, I would say, obviously, I think we're in a time of, I would saying growing geopolitical tensions. Many of us had hoped that some of this competition would be sort of benign in terms of, you know, try to see who could be more efficient, come up with more innovative products, et cetera, and hope that it not be, let's say more aggressive.

I think that the Russian invasion of Ukraine - and AES used to run the electricity of Kyiv and Rivne, so I know the country well - you know, really upset the political order. There was sort of a agreement among the great powers that you didn't invade small powers. So even though Russia had done this, let's say in lesser extent, whether it be in Georgia, whether it had been in Crimea, this was a large scale invasion, and which really disrupted gas prices. It disrupted Europeans' comfort in importing raw materials, especially gas from Russia. So this was a major disallocation, and it has led to, I think, a lot more conflict, because as I would say Europe, the United States, the West broadly said, has been trying to get Russia to stop this aggression, you know, it has also run afoul, let's say, of other countries, and led to trade tensions between, say, the United States and India, which it had a very positive effect.

So, unfortunately, this can, let's say, lessen the pace of technological change and technological sharing. There's a lot to be said of the United States and China working together.

You know, those are the two leading countries. If you look at a lot of technological change in our sector, a lot the inventions came out of the United States, and it's really been China's advantage in fabricating and massifying it. So there's a lot of complementarity here, and it, it's a shame. But I would say what really sort of changed people's mindset of what sort of world we live in is the Russian invasion of Ukraine.

Robin Pomeroy: Did that have any impact on the adoption and the development of renewable energies, though? Because Western Europe was importing a lot of oil and gas, and the invasion of Ukraine, in some ways, didn't it make people say, well, look, can you create domestically, and domestically for a lot of countries that don't have oil and guests, could be renewables? People were talking about that, I remember, when that invasion happened. We didn't know whether that would be the case. Looking back on it now in the current situation, do you think that we can feel that impact?

Andrés Gluksi: Well, first it was very costly. Europeans have paid a very high cost of having to import more expensive LNG.

When we think about commodity shocks like this, I think that the media often doesn't do a very good job of separating short-term effects and long-term affects. Because you have elasticities, to use an economist's term, elasticities of supply. If prices go up, you're going to get much more supply, but you're not going to get it overnight.

You have to drill wells, you have to build liquefaction trains, et cetera. You're going to have a supply response, but it's over time. And the same thing happens with demand. In other words, people will find substitutes.

And I think one of the things we've learned when people make predictions, whether it be for Brexit or anything like that, is that people are very creative in finding ways to, let's say, soften its effect, or at least delay its effect.

So what did we see with this? I think it was a tremendous cost. It caused social tension as well between the production of electricity. It made people question subsidies. You know, prior to this invasion, the real concern was that the Inflation Reduction Act was subsidising renewables to the extent in the States that how could Europe compete with this? There's where I would like to see a healthy competition. Let's see who can come up with the best scheme to accelerate the energy transition.

So look, think of it as a tax, mostly paid by Europeans. And other gas importers. In the U.S., I mean, I think it was honestly, from an economic point of view, somewhat beneficial for the U.S. because the high prices allowed us to take a chunk of that LNG market. And let's say prior was really supplied by Russian gas.

So I think it showed us the risks involved with depending on commodities for setting energy prices.

I think I'd also show the interdependence of countries. Really, unfortunately, that second part hasn't been taken seriously enough by all players, that how much better we are working together to face up to these crises.

Charles Bourgault: There's some people who are even like blaming renewables for the high prices of energy. And there's a lot of greenlash mentioned. What kind of benefits can consumers expect from the energy transition? What are you saying to those people?

Andrés Gluksi: It tends to be when we go to the extremes that you get sort of reducto ad absurdum, you know, that things get a little bit crazy. So, you know if you're in say Alaska, solar is not going to work very well. But if you are in the Mojave Desert in California, it works fantastically well.

So look, some of it has been a lot of subsidies, especially in countries in Europe like Germany, very early before the technologies were ready. So I would argue that many times it's better to subsidise the R&D rather than roll it out before the technology is ready because it's more efficient from an economic point of view.

It's easy to pick on renewables. But again, if Europe hadn't built so much renewables, think about the impact of the cutoff of Russian gas. It would have been much worse.

So renewables plus batteries do work. There's no question about that. And that they help drive down prices.

And there are countries, for example, where you have minimal subsidies. Take something like, we operate in Chile. We're the biggest provider of clean energy to the mining sector in Chile, which produces the copper and the lithium that are needed for the energy transition.

Energy prices have dropped in Chile before the big build out of renewables, energy was around $100 a megawatt hour. Now it's about 40, you know, with minimal subsidies. You have a $5 per tonne carbon tax.

So thinking of places like Africa, which need to electrify. I learned this in the telecom sector. You know, Africa didn't build out, you know, hundreds of miles or thousands of miles of bearing copper and go to expensive analogue systems. They jumped directly into cellular distributed networks. Look how creative they were in creating new businesses around having this mobility communication.

So when I think of Africa, they should jump directly to the new technologies. You know, a lot of places have abundant sun. And you don't have to build all of the transmission infrastructure for isolated places.

I mean, if I were a minister in Africa, was trying to electrify the country, certainly for the more remote villages, I would go to, you know, solar plus batteries plus some wind.

But what I think is needed is really sort of fundamental analysis. Some places have great wind and some places have great solar, and not to try to force the use of a technology in places where it's inappropriate.

So if you have poor solar, you know, there are other things that you can use. Now look, we also have to say, what is the goal? The goal is not renewables per se, it's zero carbon. So in the future, I think there's possibilities for enhanced geothermal, especially in the United States because we have a whole infrastructure of fracking.

You also have small modular reactors. But again, we have to think of the timeframe. That's not here now. That's going to solve our problem for the next 10 years. So renewables are, you know, what's going to work best.

And in the West, quite frankly, the economic viability of nuclear has yet to be proven. In the United States, we've built one nuclear plant, two units in the last 40 years. They're extremely over cost without massive subsidies.

So really, I tend to be biassed towards market solutions. What we really need is a carbon tax. If we had a carbon tax, this would do a lot to improve near-shoring and unshoring because if you had to pay the cost of, say, shipping a part two or three times across the Pacific, that would have a high carbon tax.

I think it's economically efficient because there is a cost to carbon. There's a cost of carbon in the climate, and there's a costs to particle pollution. So it should pay that cost.

So if you did that, you know, just think about how much renewables are competing and winning in places with basically no subsidies. If you added a carbon tax, there's no question that it would be superior.

But having said that, I'm not one who believes that we can just cut off fossil fuels overnight. There has to be a transition. I think there will always be a place for fossil fuels. Quite frankly, think of something like aviation, just the energy density of liquid carbohydrates. I don't see with current technology, we're going to have batteries or something or, you know, green hydrogen, they can truly replace it in certain roles. But that's okay. We could offset those carbons.

So my dream world would be, you know, we have free trade, we have a carbon tax, and then we let the market operate.

Robin Pomeroy: How do you impose a carbon tax, though, particularly somewhere like the United States?

Andrés Gluksi: Well, right now, I think it's politically impossible. That is true. For a carbon tax to truly work, it has to be universal.

Now, I do think that if you had, say, Western Europe, Japan, United States, Australia, Canada, together, you know, they are a sufficiently large portion of the world economy, maybe 50%, that they could have a carbon tax.

And what we have to avoid is sort of demonising, you know the other side, because if you think of China, it has probably peaked in its carbon emissions. Because of green energy, which includes nuclear, but also thinking about electrification of transportation and becoming more efficient.

So, you know, global warming affects us all. And there are going to be no winners from global warming. I mean, perhaps Putin thinks that he's going to have better agriculture in Siberia, but I think if you put everything in context, probably not. So there really are no winners in this. And so we have to work together.

I think going to the technical fundamentals is key. You know, you're not going to win ideological arguments. And I do think also defining what you're trying to achieve and then working towards it is much better than taking sort of holier-than-thou stances. You know we have to get off our fossil fuels tomorrow. I'm the good guy, they're the bad guy. It's not that simple.

And truly looking at it, I mean, I remember thinking about, say, in Europe, bringing Russian gas from the Urals into Europe over some Soviet era gas pipelines. What is the leakage? So technically, if you had a leakage of around 10%, it's worse than a coal plant. So, you know, it might make people feel good, but it's really not achieving anything.

Perhaps one of the biggest tragedies of our time is that people don't listen to expertise anymore. And that is very bad. I mean. You know, my opinion on, I don't know, open-heart surgery is as good as, you know, Dr. DeBakey in Houston, which is just simply not true. So it's true about economics, it's also true about physics, and it's too about energy.

Charles Bourgault: So you mentioned your experience in the telecom industry. Was there also a big learning moment in your experience and energy, like one time when you had a, I don't know, a eureka moment or something like that?

Andrés Gluksi: Certainly had a lot of opportunities to learn. The best opportunities to learning are your failures. You know, because what you did right, fine, but what did you do wrong?

I would say what I've learned is that execution is key. You can have a fantastic strategy, you can have fantastic technical assessment, but if you have difficulties in executing, that's going to be very difficult.

And so in our case, we had a run-of-the-river hydro in Chile. Which was an expansion of an existing facility. And it turned out to be much, much more difficult, even though on paper it was the best project the company had. So I would say that's a learning.

I mentioned another one is that you can't lean against technology. So if we get new materials for renewables, it's going to be hard to stop that. It's going be hard to stop more efficient AI programmes about consumption of electricity. It's going to be difficult to lean against better utilisation of existing infrastructure.

You can have a pro-coal policy, but if coal is not cheaper throughout the whole chain of from mining through delivery, it's unlikely to happen.

I think those are the big learnings.

Charles Bourgault: Maybe one last question about whether or not you're optimistic, optimistic about the future and our ability to address climate change.

Andrés Gluksi: Look, I'm by nature optimist because I think to be a CEO and start companies and to really change a company, AES has gone from primarily a coal generator to primarily a renewables and gas company. So to make that transition, you have to be sort of innately optimistic.

So I do believe that we will continue to make progress. And I think it will be two steps forward, one step back.

I think the question for us all is that the climate is perhaps one of the most difficult things to model. We really don't because it's chaos theory, butterfly flapping its wings and China causes a hurricane in Central America. There's some of that, but it's difficult to model everything and there are feedback loops that we don't know.

So I guess my question is, I hope mother nature gives us the time for human ingenuity to execute on this. And then if mother nature does give us a surprise, maybe that will shock us into going more quickly.

Robin Pomeroy: What's been your greatest contribution to the energy sector and the transition?

Andrés Gluksi: Look, I have been very fortunate that, at AES, we really were the first to develop grid scale use of lithium ion batteries that allowed many things. It's a little bit of a hammer, but we first used it to increase the capacity payments of existing fossil plants. But then, our goal was to use it for renewables because the great complaint about renewables, they're intermittent. Therefore there are attacks on the system. With energy storage, that's no longer true. You can overbuild, say, renewables.

So what you do is during the hours to say the sun is up, you store that energy and you supply it to the shoulders when the sun it's not up. And we have facilities, we were the first to really have 24/7 renewables by overbuilding grid and putting on energy storage.

So it has been fascinating to see how the prices drop. And we really started a global industry. So we started 15 years ago. And technically, it made sense that lithium ion batteries could work. Economically, it did not make sense.

So what has happened is on the first, we tried so many different applications to see which one made money. And second, there were the control systems that had to continually improve.

But what we saw was that we were several years ahead of the market. So if we just did energy storage for AES, it would be limited and the pace of adoption would be much slower. So what we did was spin off this business and make a joint venture with Siemens. And with Siemens, we formed a company called Fluence. We did an IPO, it was a $7 billion IPO. And today, Fluence sells energy storage in more than 50 countries.

But it's also very exciting to have companies like Tesla, to have company like BYD copy essentially your idea. So today, the entire market in the world for renewables and energy is different because of lithium ion-based energy storage. We did change the world.

And look, had we not done it, would somebody else have invented it? I think so. But I think it would be three to four years later than what occurred. So I think all of us at AES are very proud of the work we did in this and the multiple applications that we have invented for energy storage.

For example, it is a key in solving the transmission bottlenecks. Take an example, in Germany, it's being used to bring offshore wind to Bavaria over existing lines. Because since transmission lines are not used at 100% of capacity, you can store up the energy in banks. And transmit it over existing lines when that line is more available. Saving billions of dollars and saving a decade of permitting. So I would say that's one of our proudest moments.

Robin Pomeroy: Andres Gluski, the CEO of AES Corporation, based in the United States. Really interesting, he was talking about artificial intelligence. I think all three of our speakers all talk about artificial intelligence and the fact that it requires a huge amount of electricity to run these data centres and his company's involved in supplying that electricity. And he says, to keep consumers happy, the consumers that share, that also need to get electricity at a decent price, and they want clean air, there'll be demand, he thinks, for that electricity that's supplying data centres to be supplied from renewable sources. Do you think he has a point?

Charles Bourgault: Yes indeed. I think what we're seeing worldwide is that clean energy and renewable energy is making up the most part of capacity addition at the moment. So indeed if we want to answer data centre needs part of the solution if not most of the solution is via renewable energy and batteries.

Robin Pomeroy: Let's get on to our third and final CEO then could you introduce this one?

Charles Bourgault: So our final CEO on the podcast is Lei Zhang of Envision company operating from Asia. And delivering also hardware for the grid and for renewable energy as well as software to bring it all together.

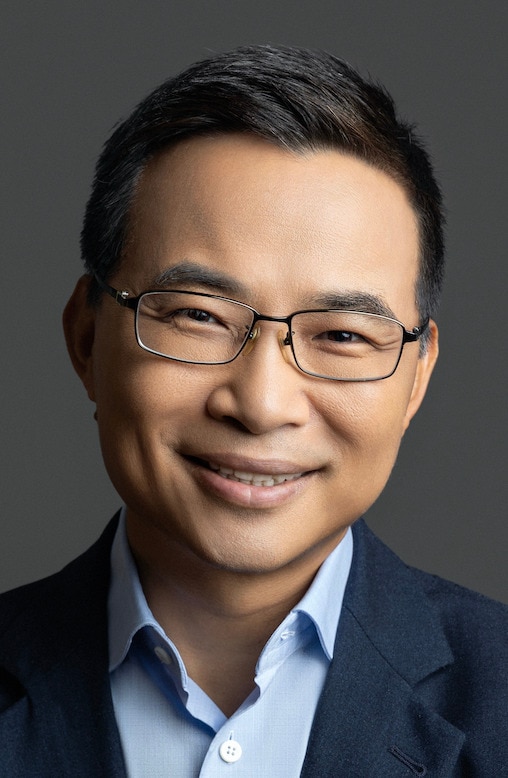

Lei Zhang, CEO, Envision Group

Lei Zhang: EnVision is a future energy system company. We believe the transition need more than equipment. The transition to net zero needs a new renewable based energy system. So it will comprise of wind turbine, solar panel, energy storage, grid technology, software, AI, green molecules. So this is the new energy system.

We believe it's so important to have a system view. In particular, we see many challenges once we are living a system dominated by renewable energy.

It will have so many great opportunities. Green, everywhere abundant and low cost. But also it's going to be very fragmented, volatile, intermittent. So how are we create a green, but reliable, robust, intelligent future energy system? It's become a very critical mission.

Charles Bourgault: And how do you see that mission advancing at the moment? Where are we at in this transition, would you say?

Lei Zhang: You know, I'm quite optimistic. There's no question about green electrons is beating fossil energy. So wind, solar plus storage is more cost competitive than fossil based electrons.

However, to achieve net zero, the electrification rate is going to be much higher than today. So we're probably now around the 30% electrification rate. In order to achieve the 90% electrification, we have to remove our dependence on the oil and the gas.

Think about maritime transportation. The diesels carries huge amount of energy in a much less costly way. So it's going to be difficult for using a battery to powering the maritime vessels. So we need green molecule. Green molecule provides not only the high energy density, but also with zero emission.

So that's why green hydrogen and the green hydrogen based derivatives like green ammonia, green methanol and SAF [sustainable aviation fuel] so they are going to be the very important driver for decarbonization for the second wave.

Today, this is still quite challenging in terms of cost, in terms of scale, in terms of speed. So from this point of view, I think we have to solve this big challenge on creating cost competitive green molecules.

Robin Pomeroy: Is that a technological challenge? Is it a policy challenge, collaboration? What is the main challenge? What needs to happen to make those green molecules available and cost effective and at a scale that really makes an impact?

Lei Zhang: I think it's kind of chicken and egg issues.

Some companies claim we need green molecule. We like to source at a good price, but there's no green molecule supply. Okay, but the producer says, okay, in order to take such a huge capex investment, so we need long term offtake agreement.

Just put example for green ammonia. There's no such a long term offtake agreement have been issued to any developer. So which make the investment bank financing, project financing is going to be difficult for the developer.

Envision, we decided a few years ago, okay, let's break through such a dilemma. We don't need long term offtake agreement. We believe in our time knowledge is going to create cost competitive green ammonia. So we start a 1.5 million tonne green ammonia project. Now the first 300,000 tonne has been commissioned. Then, okay, starting from beginning of this year, we start talk to the so-called first movers. Guys, we have green ammonia. It's going to be much cheaper than what you want in the past, but still no serious commitment. And people told us, oh, yes, sorry. So our procurement time starting with 2028, 2029. You know, this is a real test for the belief and the commitment of those first movers.

Of course, we see some country is moving. So like Korea. So they are auctioning for national green ammonia and a blue ammonia supply. So starting from 2028, 2029 with a serious quantity.

Now, of course, we see Singapore is start to forming some kind of policy, but we are making the green ammonia below $600 FOB, which is a great price. Still lack of real commitment.

So I think policy, financial scheme, playing an important role as well.

Envision, we are able to develop multiple technology because we are renewable energy system leader. We are making wind turbine, grid technology, storage, ammonia, green hydrogen, electrolyser, and the software, AI weather forecasting, AI grid together. To create this most cost competitive green ammonia. Otherwise, it's going to be much expensive than this price.

We see this wave definitely is coming, but is much weak than what we expected. Even we show a big breakthrough on the cost and supply.

And think about today's global subsidy on oil and gas, I haven't got any statistics, but it's worth to look at. No, the amount of capital have been received for subsidy, for sure, it's comparing with green molecules, this is the tiny part.

Charles Bourgault: I wanted to go back to electrification. You mentioned 90% electrification with wind, solar and battery. Do you think that's possible in every economy?

Lei Zhang: Of course. So think about the solar is everywhere. The solar panels costs is dropping significantly for the last five years, 80%, something like that.

So if you look at the energy storage system, the battery storage system, I think the cost for last three years is having reduced 90%.

Hybrid solar wind with energy storage system, now it's become very competitive. So that's why people start to think about using storage even for long duration, not only for daily or weekly, but think about even for seasonal storage. Your storage system reduce 90%. I believe for next three years, this could potentially see another 40 to 50% cost reduction.

So then why not having a 10 hours or 20 hours battery storage system, which is going to replace gas power stations in the future. It's going to be happen. Technology is relentlessly developing. So I'm quite confident to see the long duration battery storage is going to play a vital role to replace gas.

Robin Pomeroy: Can I ask you about the impact of geopolitics on the global energy transition? For example, trade tensions between China and the US. How do those geopolitical tensions impact the energy transition and the work that you're undertaking?

Lei Zhang: China is developing comprehensive renewable technology products, from electric vehicle, battery, solar PV, wind turbine and grid technology. I think China is so important to commoditize such a technology.

Because of skill, because of the industrialization, cost has dropped significantly for the last 10 years. Almost every part is 90%. So which make using renewable technology more affordable because once you have such a low cost energy generation using the low cost renewable energy from China made solar panel and the battery to power the AI data centre to train your large language model.

You can use low cost green energy to create much sophisticated chemical refineries or to run communication system, 5G or whatever.

So for every society, the cost of energy is the commodity. Just think about Europe still imports oil and gas from Middle East. Today, for instance, the challenge in Europe is the energy dependency. But Europe do have abundant renewable energy. North Sea wind, or Spain with solar or even the neighbours. North Africa has abundant renewable energy sources.

So if using the low cost generation technology, creating very cost competitive energy, electricity. Then Europe, the household living is going to much improve. People pay less.

So I think this is different angles. How to leverage low cost commodity to create a much very added economy. China made renewable technology comparing the oil and gas promoted by US now. I think they offer the two kind of choices to the world. But I believe not only from emission point of view, but from cost point of you, you will clearly see the advantage of the renewables.

Charles Bourgault: And you mentioned AI. What role do you see for AI in the transition? And are you already using it to optimise your systems?

Lei Zhang: Yes, so AI is very critical on managing forecasting the complex systems.

If you think about the climate and the weather system, it's the area [that] needs super AI because it's so complicated. Wind, solar, the rain, temperature, everything is moving every moment. So. It's the best area to apply the super intelligence to predict the weather pattern in seven days or for next month, next winter.

Also for the climate transition. We are applying the AI weather model because of the advantage of our AIoT system. So now we have significantly improved seven days ahead weather forecasting.

This has become so important. Why? Because our future energy system is going to be dependent on the weather. The weather system is becoming an energy system.

We're also using AI models for managing grid, managing wind turbine, AI storage, because storage need to communicate with grid. To know when to charge, when to discharge, how much, how fast.

We do see AI is probably the new energy system. In particular, it's going to be a heavy user of advanced AI technology.

At the same time, think about where's intelligence coming from? The super intelligence is coming from energy. People realise energy is able to creating everything. Energy is creating transportation vehicles. Energy is creating communications, 5G's. Energy is creating food. Energy is creating protein. Energy is creating steel. Now energy is creating intelligence. That's the AI. Energy is creating even currency - blockchain, bitcoin.

Energy is behind all social industrial development. This is going to be so important for our civilisation advancement.

Charles Bourgault: But some people fear that we won't have enough energy for AI.

Lei Zhang: I don't think so.

If you look at the Gobi Desert, Sahara or Australia Desert, if you combining the renewable energy from this desert, we are able to powering the planet 10 times what the planet needs, just from the Gobi Desert. This is tremendous renewable energy is there.

Robin Pomeroy: Do you think there'll be another big breakthrough in this area? You mentioned the surprising drop in the price of solar panels over the last few years, which most people didn't see coming. Can you imagine something like that happening again, a kind of a game changing advance in this area?

Lei Zhang: The renewable energy, ultimately we have a free nuclear fusion energy from solar and what we are working on is energy conversion. So wind turbines, silicon solar panels, or energy storage system is all the conversion technology.

The efficiency of the conversion devices is improving significantly. And the cost of the conversions is also continuously dropping.

For instance, the perovskite solar cell is going to have much less cost and much high efficiency as a next generation solar technology. And the sodium battery, the supply of resources, sodium is everywhere. Think about electrode of hydrogen electrolyzer are improving 30% every year with new membranes.

This is all the conversion technology. With the conversion technologies cost down and technology improvement, we are able to using the free nuclear fusion energy from the solar. This is going to be tremendous opportunity for us.

Charles Bourgault: Is there any achievement that you're proud of over the last few years with your company in moving the energy transition forward that you'd like to mention? Any moment you realise that, okay, the transition is underway and will not be stopped.

Lei Zhang: So I personally have the vision to create new coal, new oil, and a new grid. Recently, they commissioned the world's largest green hydrogen project in the Mongolia is one of the achievement. We make it not only the largest scale on the operation in the world, but also the lowest cost. And this cost under $600. Is so critical to give people the confidence.

So we are able to embrace a large scale for green molecules. And we do see the cost is going to drop significantly for next few years.

We commercialised, we continuously innovate, and we continuously drive down the cost. But what we are most proud of is the new oil project is running on the independent renewable grid system. It's not linked to the public grid. It's 100% renewable energy, wind and solar.

We create a very sophisticated grid technology. The AI grid, also even IoT technology, graph database, milliseconds simulation analysis, in order to make sure energy system is reliable, fully operational in every second without public risk.

Because we believe in the future, in order to accelerate decarbonization, we need so many independent renewable grid like what we are running today. We have to explore the most advanced grid technology.

That's why from starting point, I say Envision is not simply a equipment company. We are the energy system company. We should take responsibility to develop the most reliable and competitive renewable energy system.

And that's why I'm so proud of. Most importantly the pioneering technology, the largest scale, lowest cost, is not happening in some very developed area. It's in a remote, abundant, useless place, Gobi Desert. There's so much potential. The place used to be useless, now becoming the new space for our humanity, the new prosperity.

So if we can do in Gobi, why not the Sahara? Why not the Middle East? This also is give people, inspire people to have another angle to see, okay, renewable energy, it is not something luxury or a liability or expensive. It is the free energy and it is the only path for our human being to reach next level of development.

Robin Pomeroy: Lei Zhang, the CEO of Envision Group, based in China.

Energy independence, he's really putting the case there for, sure, oil and gas and other fossil fuels are still available. And all three of our CEOs, none of them are saying, we're going to stop using those tomorrow. But what he's saying is that renewable energy, obviously he's got an interest in selling it to us, but it's not only much cheaper than we thought it was going to be a few years ago. But also it provides independence from if you're importing your fossil fuels or energy from elsewhere. If you've once imported perhaps from his company the ability, the equipment needed to make solar power or wind power, then it's domestic energy or he even calls it free energy.

Charles Bourgault: Indeed, it's free, you just need to invest in the way to harness it, but if you can bring down that cost, then indeed you have very cheap energy.

Robin Pomeroy: And he also makes a good point about storage. This is something I didn't realise was advancing as fast as he's saying it is. One of the drawbacks of renewable energy can be that it's only available when the wind's blowing or the sun's shining. All three of our speakers have said solar and wind plus storage or plus battery. And he was making the point that there are advances being made in the technology and the price of that is coming down. Is storage and batteries really a big part of this whole transition?

Charles Bourgault: Yes, definitely. It's a big enabler. And as prices for indeed for batteries are going down, this means that we'll have more and more batteries available to pair with variable renewables. And that is probably a revolution that is unfolding as we speak in the energy field.

Robin Pomeroy: Charles, thanks so much for bringing us these three speakers. Tremendously interesting, quite detailed as well for those of us who aren't involved in this every day.

We asked each of them if they were optimistic about the energy transition. We're aiming for net zero. We are aiming for a net zero in our lifetimes. Huge, massive undertaking. Are you optimistic or are you pessimistic or are you realistic?

Charles Bourgault: I would say I'm optimistic, but it doesn't really matter because we just need to get on to it. You know, we need to do it and whether we succeed or not, it doesn't matter because as the saying goes, every fraction of a degree counts. So we just to build more infrastructure to make sure that we advance towards decarbonisation. Charles, thanks very much for joining us on Radio Davos.

Charles Bourgault: Thanks so much, Robin.

Robin Pomeroy: Thanks to Charles Bourgault, he's the Manager, Electricity Industry at the World Economic Forum. On this podcast, you also heard Christian Bruch, CEO of Siemens Energy, Andrés Gluski, CEO of AES Corporation and Lei Zhang, CEO, Envision Group.

You can find out lots about what the World economic Forum is doing on energy on the website. I'll put links in the show notes.

Radio Davos has plenty of episodes about this subject as well. Look back on our back catalogue. You can find that wherever you're listening to this or on the website wef.ch/podcasta.

Please follow the podcast wherever you are listening and if you get a moment, please give us a rating or a review.

Radio Davos will be back next week, but for now, thanks so much to you for listening and goodbye.

The Paris climate agreement set a goal of reaching net zero greenhouse gas emissions by 2050. One of the main things needed to achieve that is to stop burning fossil fuels, meaning the world has to transform how it produces and consumes energy.

In this podcast, CEOs of three very different companies on the front lines of the energy transition around the world assess where the energy transition is now, and what the future may look like.

主持::

话题:

能源转型分享:

更多集:

每周 议程

每周为您呈现推动全球议程的紧要问题(英文)