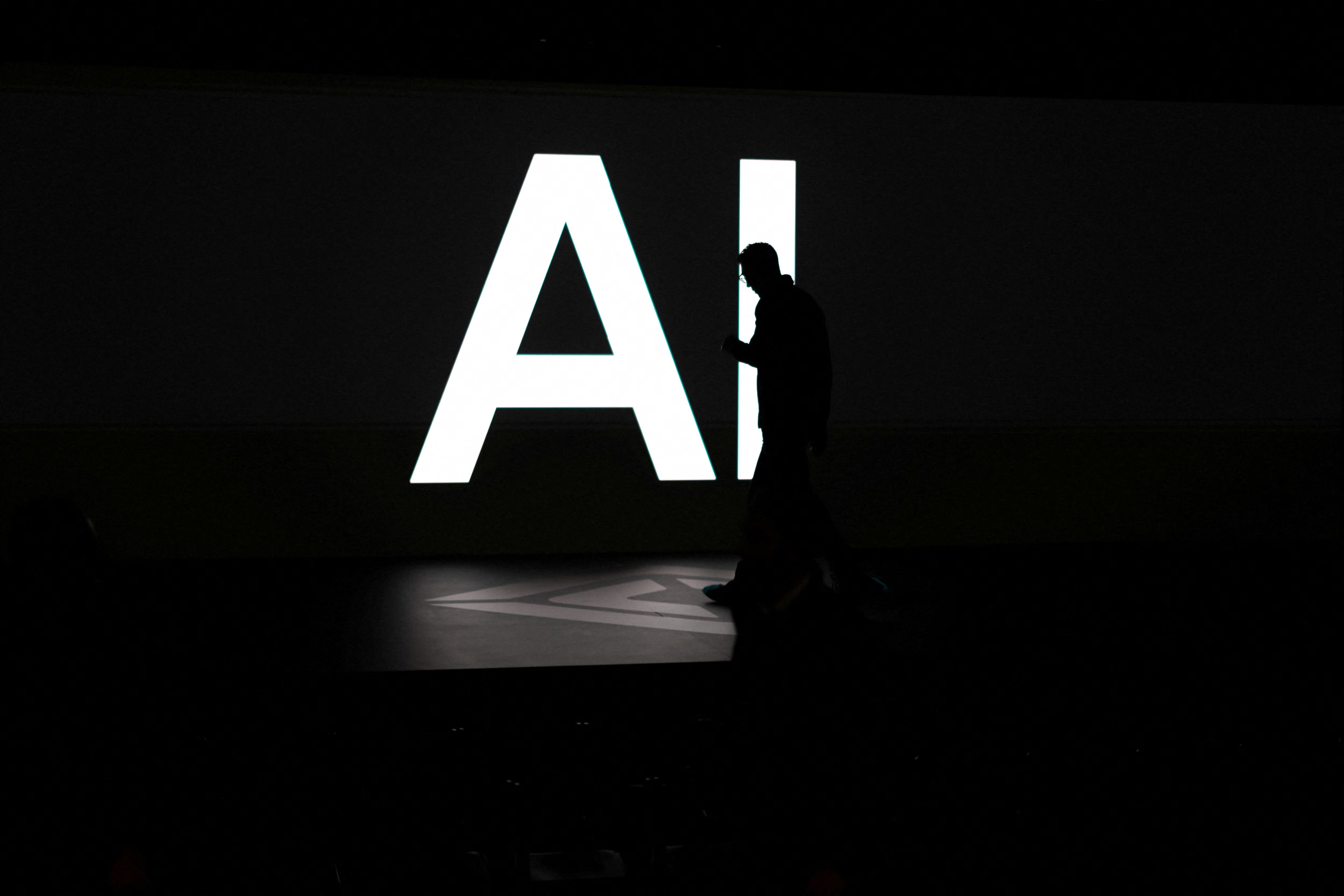

We have entered the age of "persistent disruption" - Visa's Wayne Best on the Chief Economists Outlook

播客文字稿

This transcript has been generated using speech recognition software and may contain errors. Please check its accuracy against the audio.

Wayne Best, Chief Economist, Visa: We're kind of moving from episodic shocks to more of a new operating regime. You know, one that is defined now by persistent disruption. And that's a critical word here, persistent. This disruption is not going to end.

Robin Pomeroy, host, Radio Davos: Welcome to Radio Davos.

This week, we're looking at the global economy because the World economic Forum has just published its Chief Economists Outlook.

And to discuss that with me, his name is Wayne Best. He's the chief economist at Visa.

Wayne Best: The global economy has shown, you know, pretty remarkable resilience this year. But even still, the outlook remains pretty weak, and risks, unfortunately, I think are firmly skewed to the downside.

We're not saying there's a recession, just we're going to have to start recalibrating ourselves to the potential growth rates.

Companies and economies kind of need to react, and they're going to have to move rapidly to stay ahead of these changes that are happening

As one of the chief economists reflected, we're not just weathering storms now, we've got to start redrawing the map.

Robin Pomeroy: Hello Wayne. How are you?

Wayne Best: I'm doing great. Thank you.

Robin Pomeroy: Thanks so much for joining us.

The Chief Economists Outlook to any listeners or viewers of this podcast is based on a survey that World Economic Forum does to get a snapshot of what these experts around the world think the global economy is doing right now.

Let's see your take on it, Wayne.

Uncertainty, I think, is one of the main takeaways. Tell us about global uncertainty when it comes to the economy.

Wayne Best: Well, I think the uncertainty factor really started to accelerate with the change of the administration in the United States. People started to get very, very concerned about, how should I invest? How should I move my business forward? And consumers also have that type of uncertainty also.

You know, uncertainty is something that is very difficult for people to manage. People can take bad news. Businesses can take bad news. But uncertainty in many cases can be a death knell.

I say that because, you know, do I want to invest in a million or billion dollar factory when the rules of the road start to change the next time we get together? We know that some of the changes in tariffs, for example, have created tremendous amounts of uncertainty here and around world.

So, uncertainty, yes, I think is very top of the list. Both businesses and consumers are looking for that uncertainty to really start to be removed in order to make better business decisions as they move forward.

Robin Pomeroy: I've got some some of the key figures that you've identify from the report, do you want to talk us through those?

Wayne Best: Yeah, I think the first one is really kind of trying to figure out how to adapt to that uncertainty.

Let's start with a big picture. The global economy has shown, you know, pretty remarkable resilience this year. But even still, the outlook remains pretty weak and risks, unfortunately, I think are firmly skewed to the downside.

As one of the chief economists that was included in the survey said, we're not just weathering storms, we're kind of redrawing the map. In fact, about 72% or three quarters of the chief economists expect the global economy to be a little weaker or much weaker in the coming year.

There's a lot of expectation, almost eight out of 10, that anticipate the geoeconomic fragmentation will start to intensify with trade tensions at the heart of this shift overall.

There is, you know, some benefit here that we're going to see with regards to all this uncertainty. It's allowing for a tremendous acceleration in the investment in artificial intelligence. 68% of those surveyed expect artificial intelligence to really become commercially disruptive within the next year, which is up sharply from 45% in the survey just six months ago that was done back in April, but only 40% actually expect AI's productivity impact, which is really what we're looking for, to materialize in the same timeframe within the next year.

Robin Pomeroy: That is a remarkable figure, isn't it? Let's repeat that. In April of this year, 45% of these chief economists surveyed said they expected artificial intelligence to become commercially disruptive. I might ask you what we might mean by that in a moment. That number has gone up from 45 now to 68%, almost 70%. It's going to become commercially disruptive into what timeframe? Within the next year. What do they actually mean by that, if it's not gradual increases in productivity. What do they mean by commercially disruptive do you think?

Wayne Best: Yeah, you know, so you look at what has happened with our AI gen AI so far, I mean, a lot of it has been basically assistive, providing summaries of meeting notes, you know, summarizing articles, helping in scheduling, these are all assistive type things, which are certainly pretty beneficial, of course, overall. But as I like to say, if you have saved time as a result of Co-pilot, for example, or any gen AI product, summarizing a meeting that you just have, well, that's great. What did you do with that extra time that you saved? Did you shop online? At work? Well, you can see that would be hardly a productivity enhancing type of function.

So businesses are going to have to figure this out. They're going to have to find out how to redesign their systems. And that's not easy.

But interestingly, you know, we've seen a lot of new companies starting to form, which are being built from the ground up with AI. I'm not just talking about AI providing benefits to their end product. I'm talking about the entire ecosystem underneath, HR, payroll, payables etc all this being developed with AI.

And you do it from the ground up, a small business, small business is the lifeblood of any economy. When they do that then big companies can start to look at them and say well I'm going to buy one of those companies and try to incorporate that into our overall mode of working.

So that's where it really becomes much more commercially disruptive when you can actually start changing those.

But I will be honest, and certainly as we've seen from the evidence from the survey, not too many think that that's going to happen right away. That's several years out, you know, two to five years, easily.

Robin Pomeroy: Right, and this word disruptive used to have a very negative connotations. Now it's generally meant to mean more positive things, isn't it? Innovation. Do you think that disruption will have a net positive impact on economies? Or is it, as you said, yes, perhaps, but in three, four, five years?

Wayne Best: Yeah, I think it's going to take some time. It's going to keep companies to figure out how to make this work and how to really prove that they can actually advance things.

And we're in that learning phase right now. And that growth phase, you know, if you want to talk about an S-shaped curve, we're at the very bottom of the start of this ramp up. And so we're going to have to see how people are doing it.

One of the big challenges that I see with AI and GenAI really are, just broadly just say artificial intelligence, is that you don't know what you don t know. You don't know that you can have it do these different things. But you also have to go back and be cautious right now because of hallucination or the fact that some of the information may be wrong. And so we're going to have to have proper checks and balances.

All that takes time. And just imagine getting all of that through your legal department, your ethics group, all of the various groups of large companies, and even governments, to be able to get them to the point of feeling comfortable that this can provide a doable service that would truly be disruptive in those commercial enterprises.

Robin Pomeroy: But, as we say, some 70% think that disruption is really going to happen in the next 12 months. So it's quite exciting in some ways, daunting perhaps.

Let's move on to the second theme, Wayne, that you've identified in these notes you've sent to me. Regional divergence. So we talk about the global economy. It's never easy. It's not one economy, is it? It's lots of economies that interact. This latest Chief Economists Outlook says there's a lot of regional divergence. What are you reading into that?

Wayne Best: You know, if we look back in the past, the world became very globalized. You know we all talk about the concepts of globalization, comparative advantage, various economic terms to say, let's build things in areas that have advantages, either because of labor cost or capital or natural resources, etc.

But all of a sudden, and that's what's fascinating in this particular survey, that's starting to be uncovered in a big way, things are really starting to change. They're changing because when we start to look at the global story, there are a lot of differences in the regional areas that we see.

You know, after COVID, for example, everybody started to lower their interest rates. As an example, there was a globalized change. If you look at all of the central banks around the world, it was something like 61 out of 63 central banks dropped their interest rates almost simultaneously.

But we're in a different mode now, and some economies are starting to pick up a little faster or have recognized inflation or seen inflation a little earlier, and that has caused them to start to raise their interest rates earlier than other parts of the world.

In the United States, the optimism that we've seen has certainly ticked up. You know, 49% really moderate growth, up from 22% in April. So I guess that's a level of optimism. Things are looking a little bit better. But again, I think it gets back to, Robin, the sensitivity or the uncertainty factor that maybe there's a little more certainty starting to creep in now that's allowing people to understand the ways of the road.

A natural majority, 52% of the economists that spoke, still anticipate weak or very weak growth. So we're not in for a mode of breakout levels of growth in the United States. It's going to be basically back to the potential growth rate of the U.S. economy because of the size of the labor force, which is around 2% or so.

Inflation risks, of course, with tariffs remain elevated and about 60% or so expect higher levels of inflation to really come out of it.

Let's look at Europe for a moment. You know, it's a bit steadier. 60% of the economists expect moderate or strong growth, and inflation pressures to remain relatively subdued.

You know the potential growth of the European economy, again based on the size of the labor force, which is a key factor in determining the potential-growth rate of an economy, is about 1.4%. So they're already at lower levels than say the United States, and we expect to see similar levels of growth as we go forward.

Now China stands out for growth. You know 71% of the economists surveyed expect moderate or stronger growth

But inflation inflation is really at the opposite extreme, 55% to expect low inflation and 38% very low. In fact, recent reports that have come up even after this survey that has occurred that I just looked at indicate that deflation is starting to creep into certain goods. That's something we haven't seen in a while.

Now if we look at that regional divergence, the Middle East and North Africa, the MENA countries, really are emerging as a region with the strongest growth outlook.

Of the economists that have been surveyed, 37 percent expect strong or very strong growth, up from just 22 percent in April. That's a pretty notable change and we're talking about the words strong or a very strong levels of growth.

For this region a lot has changed since the last survey. There has been a tremendous amount of growth in tourism, for example, not only intra-tourism within that region, but many people coming into that region also for tourism. Why? It's become much easier. They have created a visa system that allows for people to cross borders or come into the country, basically signing up online and paying a small fee. That type of process of removing friction from the overall process of traveling is making it much more easy to travel within that region and boy the numbers really show that so that is also helping to a strong or very strong growth.

And finally sub-Saharan Africa and even South Asia has a lot of untapped potential.

So this divergence happening across many of the advanced economies and even amongst the advanced economies, but also the advanced versus the developing economies.

As one respondent to the survey noted, this regional divergence has really become the new reality. Each economy is really going to chart its own course as they look through the fog.

Robin Pomeroy: Let's go back to disruption, which we mentioned at the start. A lot of it related to trade. And I noticed in the report also that economists don't see this as a temporary thing. This is kind of trade disruption and uncertainty is kind of embedded institutionalized. But what can you tell us about how this disruption is playing out across various geographic areas?

Wayne Best: I think if we look in the past, disruption could often occur within a local region or economy based on politics, based on weather, based on all kinds of factors, investment, capital investments, and even labor supply. All of those things have created challenges, I think, within each region at different times.

But now all of a sudden, disruption really isn't isolated. It's very much interconnected. And we've seen it become much more persistent.

In the areas of trade that you mentioned, 70% rate the level of disturbance is frankly very high, which isn't positive. Again, that gets back to the uncertainty factor, 63% expect trade disruption to last for the long term. We're in a new norm about disruption and having to live in a disruption levels across these different economies.

One of those factors that's really causing, Robin, a lot of these disruption that we're seeing is in technology. From the survey, 69% see high or very high disruption, with three quarters of them expecting it to persist.

Natural resources, the environment, you know, again, 61% rate disruption as high or very high. And again, 78% expected it to persist.

So we're seeing very large numbers of factors, like trade, like technology, and natural resources.

We also look at the global economic institutions, 72% see high or very high disruption here, warning of lasting scars if these institutions start to weaken. And given the state of affairs that we have seen for quite some time, that's certainly potential.

There was a chief economist that warned environmental risks remain deeply underestimated, and we can see that systemic spillovers are really going to be potentially inevitable.

So these are areas across the disruption, across each of these regions, that are really starting to come into view and we're going to have to start planning for them in a much bigger way. Start thinking through what that disruption looks like.

We've already seen some of that, right? Going from globalization to now we call regionalization. Each region may have a better chance of managing the trade within that region and looking at the types of technology that are available in that region and using them to the biggest point possible.

They know what their natural resources are and they know what they don't have and so they can start to determine that also and I think maybe we'll see a little bit more advancement in terms of climate issues, environmental issues, because it will impact their region. It's pretty easy to run a factory that's pumping out a lot of smoke in one region when other regions are very mindful of that type of pollution or disruption that can be caused from it.

So we'll have to see how that impacts across the individual regions as opposed to this concept of globalization as we move forward.

Robin Pomeroy: Let's talk about economic growth again, and what is going to drive that. We've seen across the board expectations for subdued economic growth with some geographical exceptions. Different things will drive economic growth in different areas. Tell us something about that.

Wayne Best: Yeah, I think the survey pointed out kind of almost a divergence in the pathways of these growth drivers across the regions. And there's some various reasons behind that.

But, you know, the advanced economies, for example, they're certainly leaning in very heavy into technology and, to the extent possible, human capital. So they're making large investments in AI. We certainly see that very very rapid increases, billions and billions and hundreds of billions of dollars in those areas because they don't want to get left behind.

The survey showed that 87 percent expect growth in advanced economies to depend more on technology and frankly the know-how. They've got a lot of people who've got to train, but even the technologists have to figure out that know-how of how to create the tools that would actually be impactful. 82% of the survey participants highlight skills and talent going to be the next big thing.

So we're going to have to start devoting even more to education. How do you use these tools? What are they about? How can I use and exploit them further in terms of, frankly, becoming more productive?

And we think about the skills and the talents, you know, demographics plays in here. Many of the advanced economies, I'm sorry to say, we're getting older, and we have to be thinking about the fact that in those demographics that, you know, we're going to start moving from a support system where we have fewer people supporting those people that are older. That's all going to create some challenges also.

So that's highlighting the skills and the talent of what's needed and being able to use the tools and technology that we have as things move forward.

On the other hand, for developing economies, over 93%, almost everybody. thought that capital is going to be the critical input 82% point to resources and energy. And here's some good news, you know, I think a lot of companies are trying to determine where to invest where they should move next I think there was a lot consideration for the past which you know, but have been coined things like Factory China, many items are produced in China.

I think that's now started to shift to considerations for Factory Africa. Tremendous amounts of people that are available, good resources. But there's still some things that need to be provided, especially capital.

So in many of the developing economies, capital is going to be that critical input.

Now, further to this in terms of the diverging pathways, trade openness is going to be very important, you know the ability to trade.

We've looked at Latin America for example and a tremendous amount of growth opportunities can occur just through cross-border trade within their own region. A lot of their trade currently is with regions outside of their own and because of the resources that are available throughout Latin America, we could see some pretty big pretty big improvements there in the area of trade openness.

Skills development, training, and innovation, and the capacity to innovate are really a lot of the top growth drivers.

But there are some inhibitors, and unfortunately they are large.

You know, political instability. 68% of the survey respondents said political instability and fragmentations of societies as potentially greater threats for the advanced economies. 58 percent cited that weak institutions as the top constraint for many of those developing economies.

Robin Pomeroy: Could I just ask you on debt as well, public debt? One quote from the Chief Economist Outlook says debt vulnerabilities once largely associated with emerging economies are increasingly centred in advanced ones. 80% of the people questioned expect risks in advanced economies related to debt to grow in the year ahead.

How do you see the issue of public debt. Is this something that policymakers are actually finally going to grapple with. It's something that's often kicked into the long grass.

Wayne Best: Yeah, I'd love to see them start to grapple with it sooner. It has been growing dramatically.

If we look at the debt that has been taken on in almost every country as a result of COVID, it put us at a new bar. We've kind of reset the framework for debt. And even in many economies that had very little debt or just a moderate amount, they've even accelerated also.

This creates all kinds of challenges, right? We just have to move in a direction that allows us to right-size our amount of debt.

The challenge, of course, is policymakers have to make some very difficult decisions. Are they going to provide the support for their own economies and their own people, or are they going to work to pay down this debt so that areas like long-term interest rates don't become problematic.

You know, I remember my kids getting very excited during COVID when they received these COVID cheques that came, you know, the additional monies that came. And they said, boy, look how great this is. I got a $1,300 check and I'm going to go do such and such with it. And, as an economist, as an economist dad, I said to them, well, just be careful what you wish for, because this is going to add to the overall levels of indebtedness. Well just several years later they were both looking for houses and interest rates in the United States, mortgage interest rates, have just skyrocketed, and we don't expect them to be lower anytime soon.

Our forecast with our economics team suggests that we're not going to see a five percent mortgage rate. And dare I say, ever. Okay, if there's some massive challenge health disruption, nuclear explosion. But I mean really we have taken on so much debt in the United States and many other economies, the ability to have lower interest rates because of the cost of servicing that debt, are going to be very widespread over time

And that's something we're going to have to pay for. So we're either going to start figuring out how to manage it better, which is not going to be something that's very favorable, because it's painful. Hey, we all know when we have debt and I don't have extra money to be able to buy something else that comes up or my car breaks down, whatever the issue is. It can be quite challenging overall to be be able right size that. But we're going to have to make those tough decisions, really globally, to start to reduce that debt in order for the economy to continue to grow and prosper in the in the future.

Robin Pomeroy: We're coming towards the end of the time we have, Wayne. How would you summarize the Outlook now, having read this report? There'll be another one in a few months' time. It's amazing how some of these figures have changed just since the last one in April. How would sum up where we're at right now?

Wayne Best: Yeah, let's land this. I mean, there's a lot of information in the report, a lot of nuances. And I think if you look at it in total, we're kind of moving from kind of episodic shocks to more of a new operating regime. You know, one that is defined now by persistent disruption. And that's a critical word here, persistent. This disruption is not going to end. And the economists said exactly that.

And further to that, that's going to create wider divergence across countries, across regions, and in some cases even across the industries.

However, the survey has been pretty clear, and, in terms of direction, risks are skewed to the downside. Most expect weaker global growth. But importantly, we're not saying there's a recession, just we're going to have to start recalibrating ourselves to the potential growth rates, certainly in the advanced economies, and what capital and human talent we can have in the developing countries to allow them to grow.

In the new design, if you will, the fragmentation is redrawing trade maps. And even supply chains, which we really haven't spoken a lot about, has really started to become very divergent. As I said, sometimes very regionalized as opposed to globalized, which is a big shift from what we've seen even over from a couple years ago.

Companies and economies are going to need to react, and they're going to have to move rapidly to stay ahead of these changes that are happening overall.

And there's a lot of depth here. AI disruption, as we talked about, is near-term. And as I said, so far it's been mostly just a system helping you out. But longer-term, it's going to have to be focused on productivity and automation. I mentioned the challenges that we have with demographics in many advanced economies. We're just not going to as many workers. And the economy can't grow at a pace unless we have those workers or improvements in productivity.

You know, it's interesting, AI might be coming at just the right time, so that we can focus on productivity overall.

And finally, divergence, I did touch upon that, but more than half of the economists expect gaps to widen between these advanced and developing economies.

And that's a little bit of a concern here. Reduced development aid, the aid specifically, is expected by two-thirds, and that's going to amplify the split. While 85% warn of global health risks being higher.

So what should we do? You know, what's on our dashboard? What's on your dashboard? What should be on your dashboard for the next couple of quarters? Let's talk about that.

You know depending on the region, the U.S. Is going to tilt towards additional rate cuts. 85% expect loosening. There's an elevated inflation risk caused by tariffs, 59% certainly see that.

But remember tariffs are a one-time price step change. It's not a systemic challenge within the economy of, frankly, too many dollars chasing too few goods. It is going to create some challenges for a slower job market though. Europe is certainly steadier, China leans expansionary, but they do have some deflation concerns.

If we look at trade and the heat map of trade, 70% of the economists said great trade disruption is very high, and many expect it, almost two-thirds expect it to be long-lived. You've got to assume that these supply chains are going to keep realigning. They're going to take a time to figure out the right size and the right trading partners that they're going need to have to make this successful.

The AI execution gap, you know, commercial pilots in using AI are growing, and people are starting to scale them. I mean, just in the last three to four to five months, it's certainly become very clear that you got to get on the AI bandwagon as quickly as you can.

But productivity are going to be the proof points of this, and we certainly see those lagging as we described earlier.

Be sure to resource your adoption plans accordingly, make sure that you're looking at the number of people in your company that are even using these tools and start to set some new incentives or new goals specifically related to those.

And then finally, I would say the opportunity set. Don't miss the upside that's happening in MENA, Middle East and North Africa, the strongest growth sentiment that we saw overall, and the longer run potential flags that we see in sub-Saharan Africa, South Asia, and Latin America. All of these, if, and I will say it again, if, financing and governance start to align.

Now here's the bottom line. The contour of the economy certainly isn't fixed yet. It's multi-changing and we've seen the changes that have happened and occurred over the last six, nine months, which is very surprising to have a global economy shift in this fashion, as indicated by this survey.

That risk, it allows us room to still manoeuver. We can still decide what is best for our companies, our countries, and our industries.

Prioritizing optionality over precision is going to happen. You're going to have to be flexible about how you adapt in this new environment.

Resilience overreach is going be something that's going to be looked at.

And certainly partnerships, back again to getting people to talk and work together. The partnerships that cross borders. Even as those same borders, what it would appear to me as they're starting to harden, they're getting more difficult in many cases.

As one of the chief economists reflected, we're not just weathering storms now. We've got to start redrawing the map. So let's make sure we're the ones holding the pen. Stay tuned, stay adaptive. Let's keep turning uncertainty into our advantage.

Robin Pomeroy: Right, so that's kind of where there's crisis there's opportunity, I suppose where there's great change, there's risk but there's also opportunity.

Wonderful, Wayne Best of Visa, thanks very much for joining us on Radio Davos.

Wayne Best: Pleasure to be here.

Scroll down for full podcast transcript - click the ‘Show more’ arrow

The global economy is moving from experiencing "episodic shocks" to "a new operating regime, one that is defined now by persistent disruption."

So says Wayne Best, chief economist at Visa, as he gives his take on the Chief Economists Outlook, the World Economic Forum's regular pulse check of the world economy and where it is headed.

Related Podcasts:

分享:

更多集:

每周 议程

每周为您呈现推动全球议程的紧要问题(英文)

更多关于 经济增长查看全部

Kateryna Karunska and Sam Grayling

2026年2月6日